Publications > Capgemini Consulting > Third-Party Logistics Study > Electronics

|

Electronics

Complexity Inside and Out

Electronics

products are often the rock stars of the consumer

and business products worlds, with buyers eagerly

anticipating the next release with the latest and

greatest features. But along with enviable demand

comes pressure to make products smaller, faster,

cooler and at a lower price point. Some electronics

products’ lifecycles closely resemble fashion:

What’s in today is out tomorrow. But even

everyday devices are feeling the heat. Everyone

wants to produce the next iPad.

Some electronics

products’ lifecycles closely resemble fashion:

What’s in today is out tomorrow. But even

everyday devices are feeling the heat. Everyone

wants to produce the next iPad.

Hitting these targets demands a fast and nimble supply chain. The challenges of attaining this fall into three major buckets: global manufacturing and sourcing issues, channel and network complexity and the implications of an intricate, high-value product set.

Electronics Manufacturing and Sourcing Challenges

Electronics products lifecycles are growing ever shorter and margins tighter, increasing pressure to lower costs and manage material and suppliers more efficiently. This has triggered the following trends in manufacturing and sourcing:

- Asset

Lightness: One industry trend is toward

fewer original equipment manufacturers (OEMs) actually

manufacturing, moving or storing their own products.

Many prefer to engage both contract manufacturers

and third-party logistics providers for these services.

For example, Sony’s adoption of an asset light

philosophy prompted the company to sell off assets

including a major TV manufacturing facility in Mexico

to Foxconn Electronics in January, 2010.

- Emerging

Markets Sourcing: Many electronics companies

have sought out manufacturing and logistics partners

in emerging markets, a move which can lower costs

but at the same time create a long, thin supply

chain. Sourcing from emerging markets also often

means insufficient infrastructure and emerging logistics

capabilities, creating challenges in expediting

freight and maintaining pipeline inventory, as well

as increasing supplier and global trade compliance

risks. 3PLs with experience in these markets can

play a critical role in devising strategies to overcome

these obstacles.

- Global

Supply Chain Complexity and Risk: Too many

product lines and too many components sourced from

too many faraway places creates a complex, costly

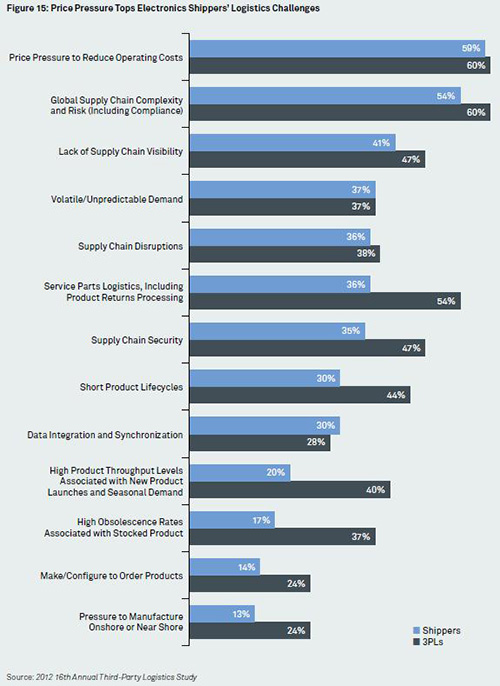

and long supply chain. As seen in Figure 15,

supply chain complexity and risk is the second-highest-ranked

challenge for shippers.

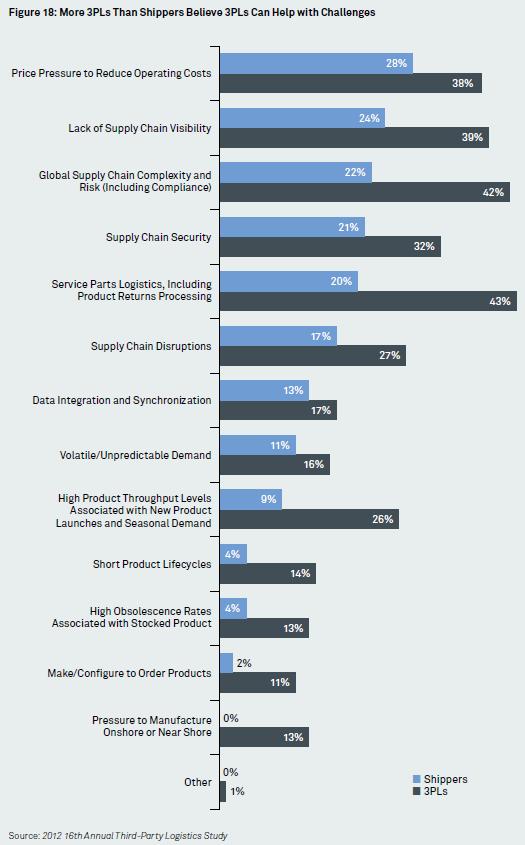

Figure 18 reveals that 3PLs are somewhat more confident in their ability to help address this challenge than shippers are (42% to 22%), perhaps because more of the cost emphasis is on the product itself and not the logistics wrapped around it. An exception is Philips, which merged two divisions, both selling to retail and at times to the same customers, in an effort to reduce complexity and lower its warehouse count.

- Make

to Order/Make to Stock: A make to order

production strategy enables electronics companies

to customize products such as computers to customers’

exacting specifications. Dell achieved significant

supply chain recognition for its work toward its

make to order supply chain model. The majority of

electronics companies in the survey (78%) agree

that for most electronics companies, a make to order

supply chain model may not always be as cost effective

as a make to stock model. It can also lead to inventory

obsolescence, especially when product lifecycles

are short. Dell maintains as many as six supply

chains. Business products are made to order, but

differing demand requirements mean some move via

air freight while others leverage alternative modes,

according to a Supply Chain Digest Webcast. Dell’s

retail products are made to stock and planned well

in advance to get products to market cost effectively

for peak seasons.

The bottom line is that one size does not fit all, even within one electronics company, due to varying market and customer needs.

- Postponement:

A related strategy favored by electronics manufacturers,

which both reduces inventory and provides a higher

level of customization, is postponing final configuration,

including packaging, until the product is in or

close to the market where the product will be consumed

– services that may be performed by 3PLs in

these markets.

‘‘People want the benefits of manufacturing in China, but are doing more packaging in the US,” as well as light assembly where possible, says Wally Shaw, Market Group Supply Lead, Americas at Philips Consumer Lifestyle. ‘‘This helps with forecasting by reducing the number of SKUs you are planning, and also helps reduce cube in transportation by using a bulk pack.”

- Price

Pressure: Shippers view price pressure

to reduce operating costs as their top logistics

challenge (59%). One increasingly common solution

is to shift from a heavy emphasis on fast but costly

air freight to other modes according to specific

channel needs, but this requires significant advance

planning. Nearly two-thirds (65%) of electronics

shippers in the survey favor air freight over slower

modes to shorten supply chain transit time. 3PLs

believe they can play a larger role in helping electronics

shippers address this challenge than shippers do

(Figure 18, 38% vs. 28% of shippers).

- Use

of Contract Manufacturers as 3PLs: The

lines between industry groups are blurring as contract

manufacturers in emerging markets offer services

that are more traditionally associated with 3PLs,

a trend noted by about two-thirds of shippers and

3PLs in the survey. Most common services include

transportation management, warehousing and distribution

services and returns management.

Some contract manufacturers are offering the more ‘‘advanced” services typically provided by 3PLs, such as supply chain network design, logistics planning and consulting services. Contract manufacturers see this as a logical extension of their services and a higher-margin opportunity. Discussions with 3PLs reveal that they do not see this as a major threat yet, since logistics is their core competency and they believe that electronics companies will choose them over contract manufacturers for complex international logistics needs.

- Environmental and Social Sustainability: Like many industries, electronics manufacturers are concerned with CO2 emissions and fuel consumption, particularly with long supply chains. Manufacturing byproducts such as lead from printed circuit board production are an additional concern; 70% of heavy metals in US landfills come from discarded electronics products, according to Supply Chain Brain’s High Tech Outlook, February 2011. Companies – and savvy 3PLs – are getting creative to solve materials and packaging problems. Dell is trying protective packaging made of bamboo and even mushrooms and is scaling down package sizes to fit more on a pallet, according to an April, 2011, article in Fortune.

Complex Networks and Channels

The electronics industry is notoriously segregated, with multiple players involved in the supply chain, not all of which are marching to a common beat. These players include:

- Component suppliers

- Contract Manufacturers, Original Design Manufacturers and Joint Ventures

- Original Equipment Manufacturers/ Brand Owners

- Distributors/Partners/Value-Added Resellers

- End Customers

Electronics is also a highly dynamic industry: Technology changes so rapidly that many companies are driven to failure due to their inability to keep up with changing technologies. That in turn drives significant merger, acquisition, and divestiture activity; Cisco alone has acquired more than 145 companies in the last 18 years, according to the company’s Web site. Motorola recently split into a consumer products company and a business and government products company while selling off a division that makes network infrastructure equipment.

Further complicating matters, electronics companies sell into many vertical markets, each with its own unique needs. Among the most trying is retail, which offers opportunity but also complexity to electronics supply chains. Among the challenges of interacting with retailers:

- Inaccurate retail-level forecasts

- Retailers’ risk tolerance

- Exacting vendor compliance programs with significant penalties

- Consumer electronics products often have a long lead time and a short product cycle, which creates obsolescence or excess stock

More than two-thirds of electronics companies in the survey (73%) agree that establishing a branded retail presence themselves is a good way for consumer electronics manufacturers to drive increased revenue.

Multiple layers, mashed-together supply chains and the specific challenges of retail channels introduce cost, safety stock, forecast challenges and additional time into logistics processes.

One impact can be seen in electronics companies’ forecast accuracy, which averages 60% to 70%. Chris Armbruster, Senior Director, Business Transformation, at Motorola Solutions, who participated in the ASE workshop in Chicago, noted that the vertically dis-integrated supply chain common in electronics slows and often limits the sharing of forecasts, leading to a bullwhip effect in inventory levels at both the retail and sourcing levels, when changes in supply or demand occur. Sharing information on true demand more quickly would result in improved forecasts and reduced inventory levels. Electronics companies must be agile to adapt to market changes and unanticipated events, such as the recent Japanese tsunami or earthquake in China, and use demand sensing and shaping to detect and influence demand.

Another challenge is to design a common, cost-efficient infrastructure across supply chains. Lean is a common goal – reducing inventory, containing SKU proliferation, and limiting fixed assets, such as in Sony’s supply chain, described previously.

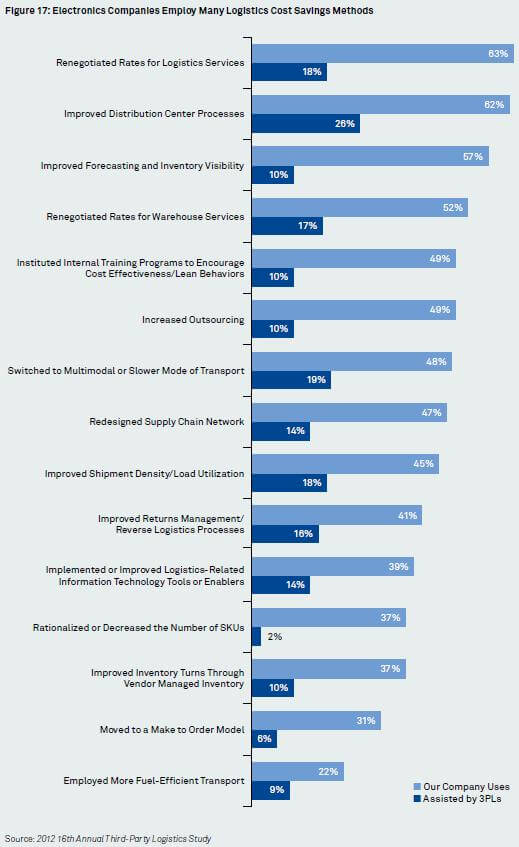

These challenges provide opportunity for 3PLs to offer services such as visibility, setting up inventory hubs in key locations, helping to rationalize inventory across the supply chain and finding ways to reduce cycle time on transit legs. Fully 55% of 3PLs report that they can help electronics companies redesign supply chain networks, which can help them respond to differing channel needs while sharing common infrastructure and services wherever cost effective. However, as seen in Figure 17, only 14% of shippers use 3PLs for this service. To capture more of this business, 3PLs need to invest in understanding the customer at all levels in the organization. An electronics manufacturer’s Supply Chain Manager participating in the ASE workshop in Utrecht noted that in his experience some 3PLs lack the ability to effectively respond to shippers’ organizational changes.

Consumer electronics products share characteristics with fashion retail (velocity) and consumer products (short lifecycles, demand volatility, peak season demands); 3PLs with experience in retail and consumer products can also cross-pollinate best practices in product distribution and demand management with electronics companies.

High-Demand, High-Value Products

Electronics companies build products people want, with the latest, most in-demand features that appeal to specific markets. That makes them high valued – and subject to theft, counterfeit and the whims of consumer tastes. These are some of the challenges this poses:

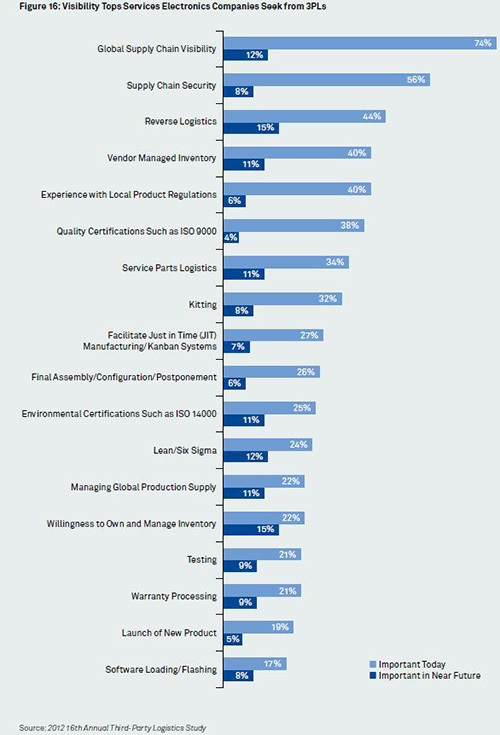

Visibility: Global supply chain visibility is a clear priority for electronics shippers. In Figure 15, it’s the third-most-cited logistics challenge (41%). Electronics shippers in the US rank this more highly than those in Europe and Latin America, and larger shippers place more importance on it than smaller companies. Visibility is essential to provide inventory availability and order status to customers as well as to provide security while in transit.

In Figure 16, 74% of electronics companies cite visibility as the top service they would like to see from 3PLs, no matter the size or location of the shipper. A leading computer manufacturer, for example, has begun to pursue a model in which a 4PL manages all of its 3PLs in a given country in order to ensure visibility.

Figure 17 reveals that improved forecasting and inventory visibility is the third most-used cost-saving strategy by electronics companies, although curiously, despite the fact that 3PLs are ideally situated to provide visibility to customers, both shippers and 3PLs report that 3PLs are not very likely to be assisting in this improvement process. Perhaps 3PLs are providing sufficient visibility, but work needs to be done on the shipper side to maximize its use.

Security: As seen in Figure 15, 35% of shippers call security a supply chain challenge; while theft of electronics goods has steadily declined over the past five years, it still represents 1 in 5 thefts across all industries, according to FreightWatch’s Annual Supply Chain Survey. Figure 16 reveals that security is the second most important capability that electronics companies look for when they hire 3PLs. Security is a particular priority in emerging markets which don’t have all of the protections available in mature markets. Technologies can help, such as covert and visible shipment tracking solutions, GPS and engine shutdown systems, as well as practices including driver training and use of transportation security companies such as FreightWatch. As the results indicate, shippers are looking to 3PLs to enact these measures.

Counterfeiting: A related need is to combat counterfeiting of goods through prevention and detection; electronics companies must thoroughly vet their suppliers and employ security measures for component parts as well as finished goods. Package seals with serial numbers are an important anti-counterfeit measure. One potential concept is to borrow e-pedigree practices from the pharmaceuticals industry; 3PLs could provide the supply chain integrity and manage the component pedigree processes.

On-Board Intelligence: Electronics companies are beginning to tap the digital supply chain for applications such as remote monitoring and diagnosis. Diebold, for example, enables predictive maintenance of ATMs via an embedded device, according to a company white paper. The company is notified when a component is at risk of failure and dispatches a service repair person with the correct part before it ever affects a user, reducing costs and increasing customer service. 3PLs could act as the centralized depot in this scenario to receive service messages and send replacement parts.

Packaging: Shiny packaging for often-delicate electronics products is designed to attract customers, but often requires outer boxes to protect it. Electronics companies are testing cost-reduction and sustainability strategies such as using new protective materials, including the mushrooms and bamboo, as well as smaller packages and postponement of light assembly and packaging to the destination market — also a SKU reducer, and an opportunity for 3PLs.

Many retailers place electronics cartons right on the sales floor. If this packaging is too thin, it is susceptible to damage, and glossy coatings can be slick, causing cartons to shift in transit and pallets to collapse, damaging cartons and, potentially, contents. Sony solved this problem by improving shipment integrity through the use of corner boards, banding, air bags and improved shrink wrapping techniques.

Local Market

Customization: Individual markets come

with their own appetites and preferences, such

as 220-volt electric service in Europe and Asia

with different electrical outlets in different

countries vs. 110-volt in The United Sates and

Canada.

Regulation may also dictate specific design features.

3PLs might help electronics companies with software

downloads or minor localization of the hardware,

such as power supply units, as well as insight

into local regulations and import/export requirements,

especially in emerging markets.

Short Lifecycles: Like fashion apparel, many electronics products are made in emerging countries such as China, Taiwan, India and Brazil and consumed in US and European markets. This means a relatively long supply chain for lifecycles that often run just six to 18 months, creating obsolescence issues.

These short lifecycles combined with the challenges of accurately forecasting demand also means inventory obsolescence is a significant problem for electronics companies, particularly for make to stock. The majority (69%) of electronics shippers believe 3PLs can help them deal with inventory obsolescence by proactively identifying slower moving items and items that have been replaced with newer releases.

3PLs could help to identify at risk inventory in the warehouses that they manage, as well as arrange intermodal and other consolidation services to increase the supply chain velocity without dramatically increasing transportation costs. ‘‘You need a very good level of integration to be adaptive and flexible to cope with these shorter life cycles,” says Tony Xia, Sr. Logistics Manager with Emerson Electric.

When inventoried

items become obsolete, 58% of electronics

shippers in the survey agree that online auctions

are an important means for electronics companies

to reclaim some value. Facilitating online inventory

disposition is the next logical step in a 3PL

value-added service offering.

A number of electronics companies use FreeFlow,

provider of online private marketplaces and auctions,

to sell at-risk inventory through secure channels

for each stage of the inventory aging process.

The Role of 3PLs

As seen throughout this chapter, electronics companies favor outsourcing in both manufacturing and logistics services. That’s especially true in emerging markets. Yet there is a clear gap between the services 3PLs are currently providing and the additional value they could provide.

As seen in Figures 15 and 18, electronics shippers give low marks to 3PLs’ ability to solve their top logistics challenges. The largest gaps occur on their highest priorities: 59% call price pressure to reduce operating costs their top challenge, while just 28% believe 3PLs can help them with this challenge. A similar gap is revealed in 3PLs’ ability to help electronics companies with global supply chain complexity and risk, including compliance. 3PLs themselves also see a gap, albeit smaller, between these challenges and their involvement in helping their customers with these challenges.

The same is true in top savings methods used by electronics companies in Figure 17; there are significant gaps between strategies used and assistance by 3PLs in those efforts, confirmed by 3PLs themselves.

At the ASE workshop

in Utrecht, one contract manufacturer shed some

light on one of the reasons shippers’ may

not seek to undertake problem-solving with 3PLs.

‘‘They do not bring cost reductions and a

lean approach to the table very often,”

he said. ‘‘They will do only what they are

asked to do; they do not proactively offer many

value-added services.”

It’s clear in Figure 18 that 3PLs see opportunities to support shippers in ways electronics shippers themselves do not. Both sides need to meet in the middle: 3PLs need do a better job in selling the quality and value of their capabilities to electronics customers, and shippers need to be more open to collaborating with 3PLs to address their top challenges.

Generally speaking, electronics shippers view 3PLs as skilled and capable at fundamental logistics capabilities, but don’t necessarily turn to them for collaborative problem-solving to address their more strategic supply chain challenges. The results in Figure 16 confirm that they would like to see more. Embedded throughout this chapter are suggestions for significant contributions that 3PLs can make to address electronics companies’ most vexing supply chain challenges.

|

Index:

About Capgemini Consulting

With more than 115,000 people in 40

countries, Capgemini is one of the world’s

foremost providers of consulting, technology

and outsourcing services. The Group reported

2010 global revenues of EUR 8.7 billion.

Together with its clients, Capgemini creates

and delivers business and technology solutions

that fit their needs and drive the results

they want. A deeply multicultural organization,

Capgemini has developed its own way of

working, the Collaborative Business ExperienceTM,

and draws on Rightshore®, its worldwide

delivery model.

Capgemini Consulting is the Global Strategy

and Transformation Consulting brand of

the Capgemini Group, specializing in advising

and supporting organizations in transforming

their business, from the development of

innovative strategy through to execution,

with a consistent focus on sustainable

results. Capgemini Consulting proposes

to leading companies and governments a

fresh approach which uses innovative methods,

technology and the talents of over 3,600

consultants worldwide.