|

Steering

Team: Roy Lenders, Capgemini Consulting Netherlands Prepared

and edited by: |

Executive Summary: Global Trade Flow Index - Q3 2011

|

-

Weak US economy, debt crisis in the Euro zone

and worries about inflation coupled with tighter

monetary policy in Asia have clouded the outlook

for global economy in Q3 2011

- Weakening flows

of goods and services reflected in reduction of

global trade by 1.3%, on QoQ basis in Q3 2011

- Euro zone

debt crisis and an appreciating Euro constrained

the exports from European nations, as total trade

reduced by 2% in Q3 2011, on QoQ basis

- US recovery slowed

down significantly in Q3 2011 due to its financial

turmoil; and US dollar is expected to weaken further

especially against growing market currencies,

impacting its trade volumes

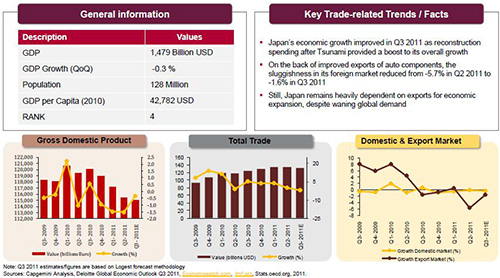

- Japan’s economic

growth improved in Q3 2011 as reconstruction spending

and improved exports provided a boost to overall

growth

- Amongst BRIC nations,

the outlook for Indian and Chinese economies remains

positive, driven by heavy investments and exports

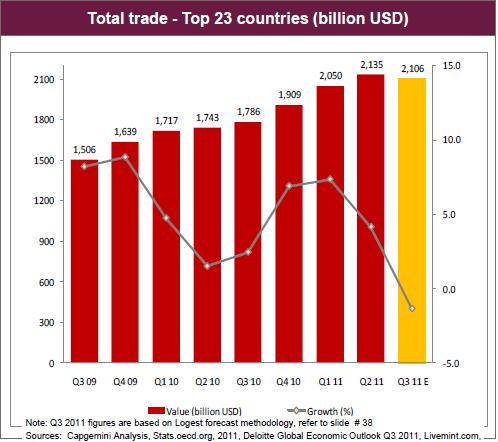

Major economies saw their trade dwindle in the third quarter of 2011, with growth falling down to sub-zero levels

Key developments

-

Global trade growth decelerated further as trade

volumes dropped by 1.3% QoQ, to touch 2,106 billion

USD in Q3 2011

- The deceleration in import and export growth

affected all the G7 nations and the emerging markets,

except China and India

- Euro zone experienced a drop in their total

trade by 2% QoQ in Q3 2011, as growth of exports

was constrained by an appreciating euro

- Due to current financial turmoil, US dollar

is expected to weaken further especially against

growing market currencies, impacting its trade

volumes, with total trade reducing by 2% QoQ in

Q3 2011

- India was the only country to see a sharp pickup

in export growth, from -4.5% in Q2 2011 to 1.2%

in Q3 2011, led by demand for cars, petroleum

products and precious stones

Index

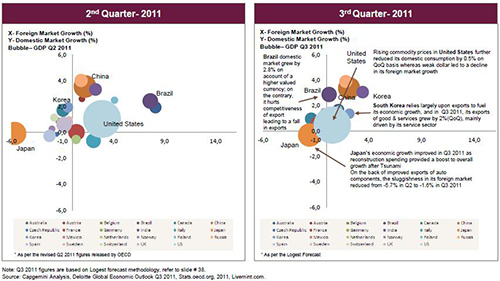

US slipped to second position with China emerging as the leading economy in the third quarter of 2011

Indian economy performed well in Q3 2011 moving one rank up, backed by strong domestic demand and improving exports (2/2)

While rising commodity prices and weakening dollar impeded US’s growth, reconstruction spending and resumption of exports helped Japan to grow in Q3 2011

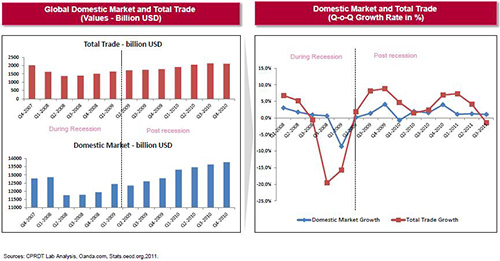

While local economies are still growing, global trade is declining – are we seeing the early impact of protectionism and a trend back to local-for-local manufacturing?

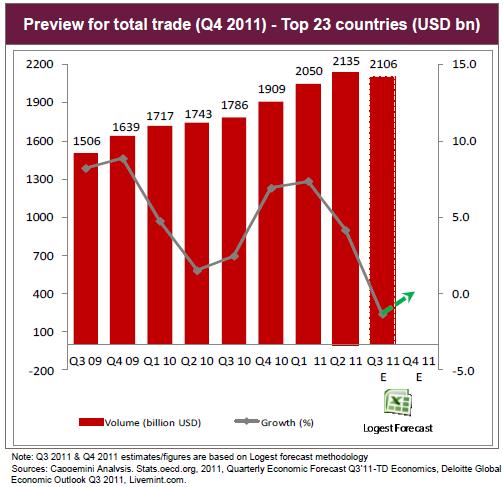

Preview Window for Q4’11

World trade is expected to grow in Q4 2011 although the risks of sovereign debt crisis in Europe still remains

Key Risks

- Inflation (high food prices and volatile commodity markets) is a key risk for both emerging and developed markets

- Ongoing US fiscal imbalances also run the risk of creating instability in financial markets

- Geopolitical instability and sovereign debt crisis in Euro zone could be the key risks to overall outlook of the global business environment

- As growth slows in most of the leading economies and investor confidence weakens, there is a risk for world economy to step back into ‘‘recession zone”

Highlights from some of the major institutes for the global economic outlook for the remainder of 2011 and for 2012

Appendix

Country Profiles

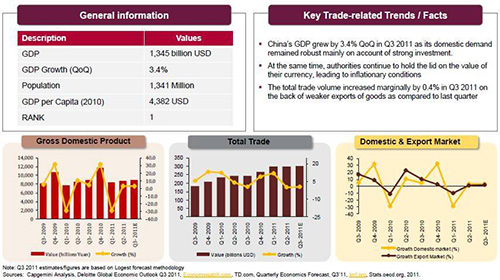

China

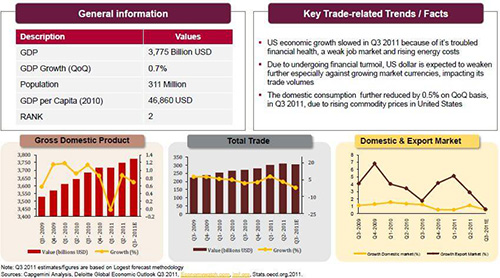

United States

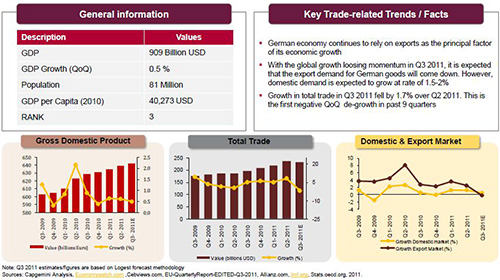

Germany

Japan

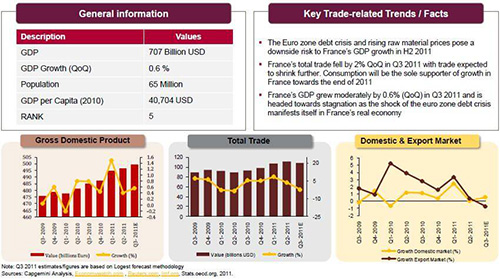

France

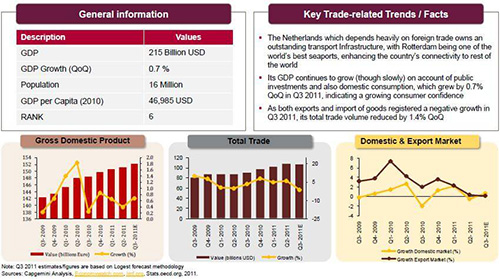

The Netherlands

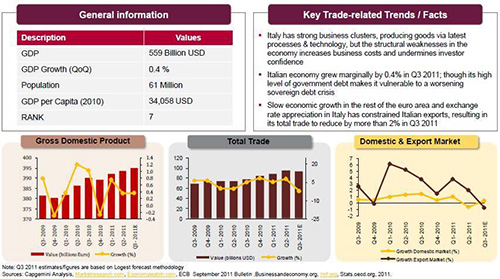

Italy

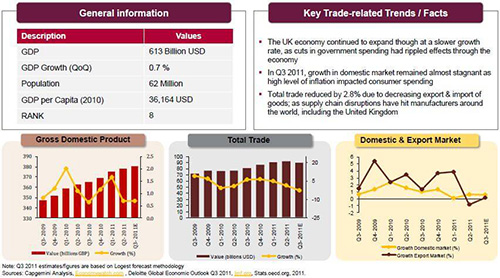

United Kingdom

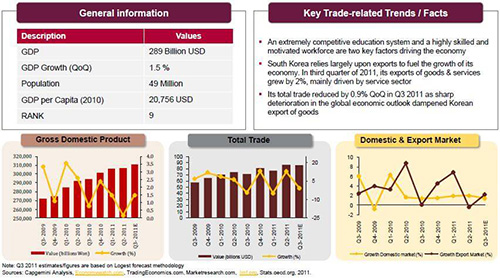

Korea

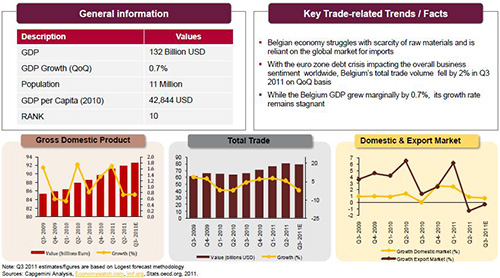

Belgium

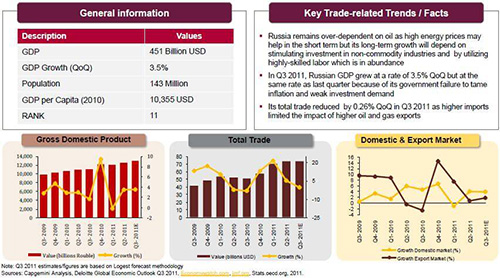

Russian Federation

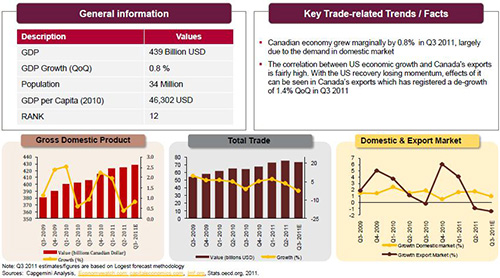

Canada

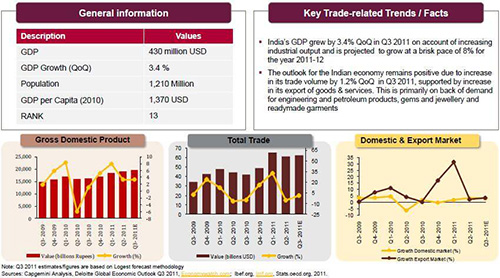

India

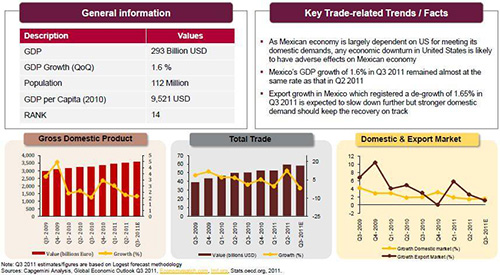

Mexico

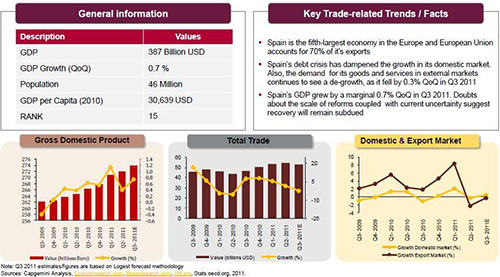

Spain

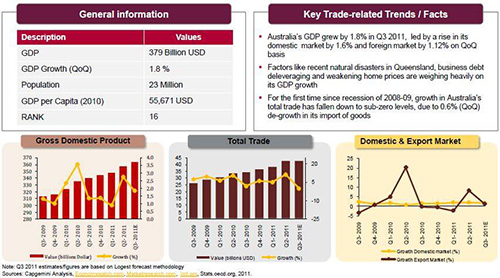

Australia

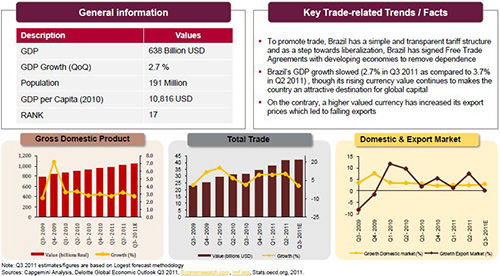

Brazil

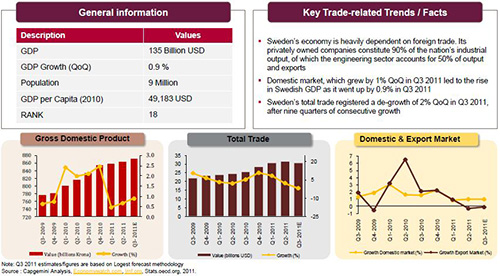

Sweden

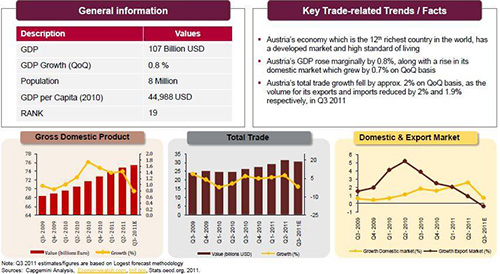

Austria

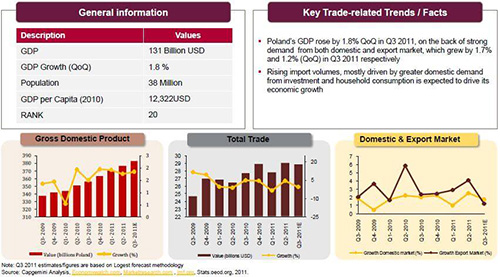

Poland

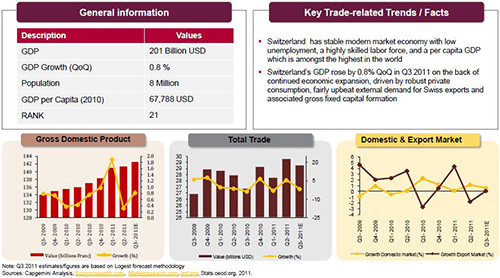

Switzerland

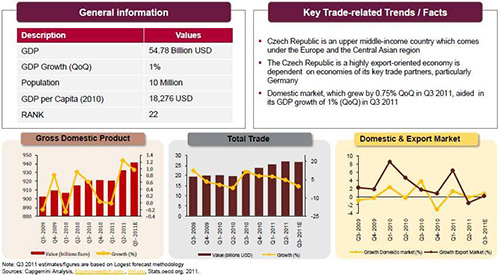

Czech Republic

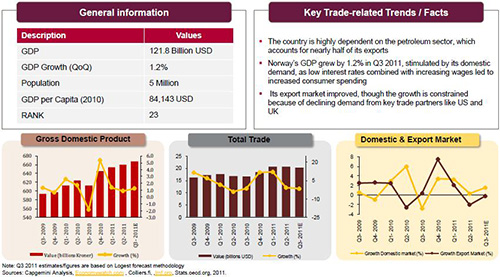

Norway

Methodology & Base Data Files

Methodology and Data Sheets

Forecasting Methodology

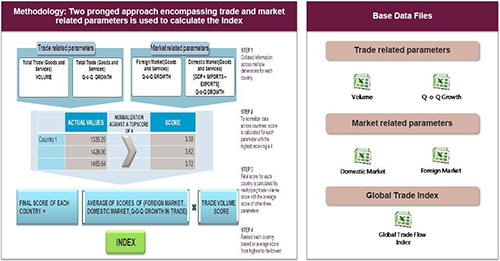

While predicting the Global trade index, we follow the following steps as mentioned below:

a. LOGEST Calculation:

a. Apply LOGEST Formula (=Logest (Historical Data

Range)-1) to the historical data of trade, GDP,

Domestic and foreign market, until the latest

available quarter

b. From the derived LOGEST value, predict the

next quarter data by multiplying it with the previous

quarter and adding the factor into the previous

quarter data

b. Adjustment Factor Calculation:

a. Calculate the variance of prediction against

the actual for last 4 quarters and calculate the

average variance

b.Multiply the average variance % with the predicted

figures to get the adjusted forecasting

c. Finally, predict the Global trade index based on the adjusted figures

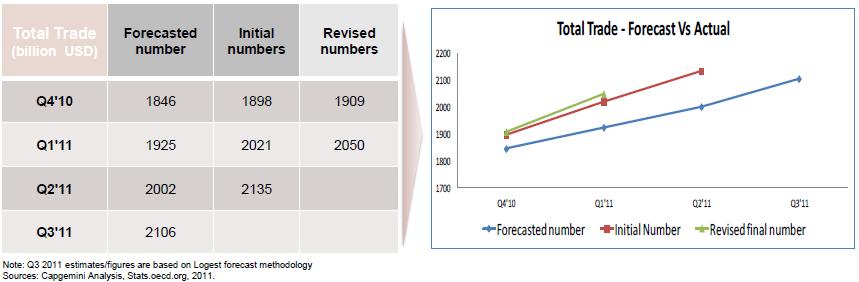

Comparison of ‘Forecasted and Actual values’

•

Forecasted number : This number is arrived by

using LOGEST Forecast Methodology, basis numbers

available for previous quarters

• Initial numbers - Data for current quarter:

These are the actual values available on OECD’s

website. It comprises estimated number for some

of the countries (estimates are either provided

by OECD or some estimates are made by our team

in India basis analyst report/ news articles)

• Revised number : Updated actual numbers

available on OECD’s website. OECD’s

website is regularly updated by actual numbers

made available from each individual country (incorporating

any seasonal adjusted changes, if any)

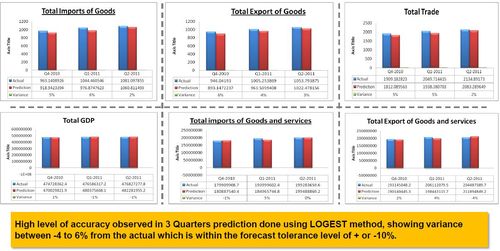

Variance between Actual vs. Predicted values as per LOGEST method

|