Publications > Capgemini Consulting > Third-Party Logistics Study > Emerging Markets

Emerging Markets

Opportunities for Driving Corporate

Growth

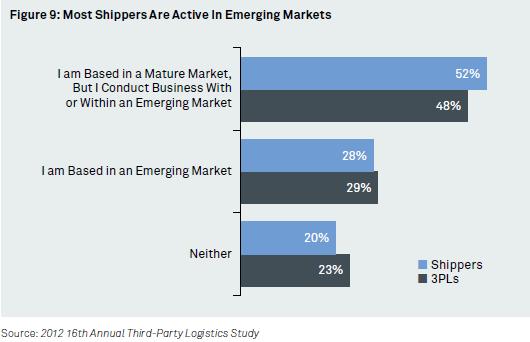

For many companies, doing business in emerging markets is no longer a nice-tohave; it’s a must-have to fuel continued growth. For example, General Motors sold more cars in China than it did in the United States last year, and PepsiCo captured about half of the Russian juice market through an acquisition, according to a CNNMoney report. As seen in Figure 9, a substantial 80% of shippers in the survey conduct business with or within an emerging market, with the majority (52%) doing so from a mature market and 28% from within emerging markets.

Among 3PL respondents, 77% conduct business with or within an emerging market, 48% from a mature market.

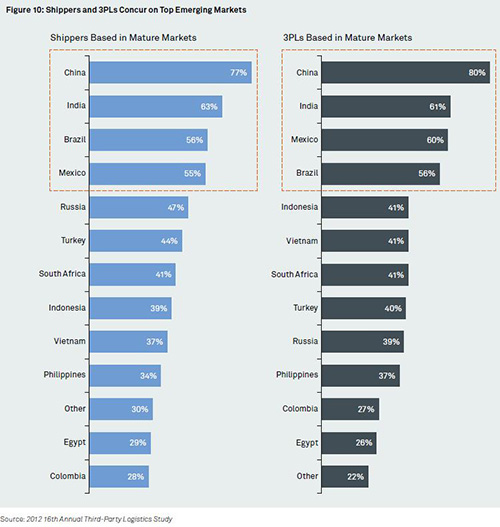

We define emerging markets as nations with economies that are experiencing rapid growth through industrialization. Mature markets are largely industrialized nations with economies growing at a slower, steadier rate. As seen in Figure 10, shippers and 3PLs in mature markets concur that their top emerging market opportunities are in China, India, Brazil and Mexico, though their rankings differ a bit.

Market Expansion Challenges

The potential benefits of moving into an emerging market are often far more clear than is the correct path to establishing business there, particularly when making logistics decisions. Successfully balancing risk and reward requires a careful assessment of the unique characteristics of each market.

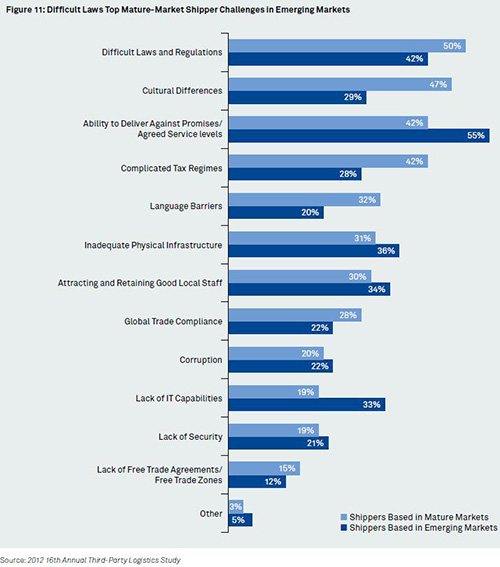

As seen in Figure 11, for shippers based in mature markets difficult laws and regulations, cultural differences, the ability to deliver against promises or agreed-to service levels and complicated tax regimes top the list of challenges. Because of such obstacles, ‘‘I could set up a new operation in a more mature market in much less time than in an emerging market,” says Gokhan Cakmak, Global Logistics Manager for Oriflame. ‘‘This is mainly due to the state of laws and regulations as well as the infrastructure and lack of international 3PL players present in these markets.”

Global trade compliance also represents a hurdle for many companies operating in emerging markets. For example, one Logistics Director for a US-based apparel manufacturer described the application of customs regulations in Asia as a vexing challenge. ‘‘The authorities can become bureaucratic and are normally not very transparent, leaving a lot of execution and interpretation to the field officers, and they can be very erratic in their classification.”

‘‘Bureaucracy and local processes make working in emerging markets more challenging,” says Cyrill Gaechter, Head of Marketing and Sales for Panalpina Black and Caspian Sea. ‘‘In more mature markets it is less complex; however the emerging markets are catching up continuously. Proper preparation such as documentation is of high importance around the world but even more critical in emerging markets to achieve reliable end-to-end-service.”

Concerns vary by market and industry. For example, shippers in electronics express far more concern than the overall respondents (45% vs. 22%) about global trade compliance, as well as attracting and retaining good local staff and lack of security for their goods.

Indeed, in contrast

with the overall survey respondents, 3PL Study

ASE workshop participants and focus interview

participants assert that security and counterfeit

intervention are key considerations in operating

global supply chains: How well do you know the

suppliers you’re working with and the quality

of their due diligence?

Governments that are clear and consistent on their

security metrics and initiatives make it easier

to manage risk than those where security efforts

are less evident, notes one US manufacturer. Some

shippers engage transportation security providers

when they perceive a high level of risk.

In focus interviews, several experts also cited green concerns as they move into emerging markets. One Head of Distribution for a communications equipment manufacturer noted the difficulty in reducing its CO2 footprint, which requires limiting air freight and road transportation, while catering to the sales growth expected in the next two years. ‘‘To minimize these modes we need to plan ahead to allow for alternative modes like sea freight and rail,” not always an easy task in a fast-growing market.

Case in Point: Brazil

Brazil is representative of the risk/reward challenges posed by an emerging economy. Brazil will play host to two mega sporting events, the FIFA World Cup in 2014 and the Olympics in 2016, events which are driving a large-scale infrastructural improvement program. The Brazilian government plans to invest up to US $880B in an economic stimulus program by 2014 to propel growth, with a portion of those funds devoted to upgrading its infrastructure, primarily roads and railways, but also ports and waterways. The government is also offering eligible corporations a 75% corporate tax reduction on ‘‘exploration profits” until 2013. Brazil’s gross domestic product average growth rate from 1991 through 2011 was 3.26%, according to Trading Economics.

A critical step in Brazil’s growth was the formation of Mercosur, the South American free trade agreement. Regional growth together with the tax incentives available in free trade zones such as Manaus have attracted global manufacturers such as Sony, Whirlpool, Samsung and Honda, as well as international 3PLs, according to a story in DC Velocity. Fast growth in the 3PL market has enabled the emergence of modern, specially built warehouses that meet the needs of multiple shippers. More than 90% of Brazilian companies outsource transportation, according to a survey by BDP International, while 75% outsource other activities, such as customs expediting and warehousing. Quality of service has become a key metric for Brazilian shippers.

However, for all of its opportunity, Brazil presents some logistics challenges:

- Byzantine Tax Laws: Brazil’s

complex tax laws can vary significantly among

regions, with at least 70 different types of taxes,

many of which require monthly debits and credits.

Enforcement is notoriously inconsistent. For example,

regulatory law requires products manufactured

in Brazil to be returned to their point of origin

for disposition. One electronics manufacturer

was excused from compliance in 2009, then required

to follow the regulation in 2010, and was once

again excused in 2011.

In addition, companies ‘‘must get a license for a warehouse to ship to customers, and then goods can only flow from that warehouse,” says Wally Shaw, Market Group Supply Lead, Americas, for Philips Consumer Lifestyle. ‘‘You cannot ship from an overflow warehouse; you have to ship the goods back to the main licensed warehouse, which is very inefficient.”

- Limited Infrastructure: Brazil

is best considered as different countries inside

one country in terms of its infrastructure and

markets. In the south and southeast regions, there

is a big saturation of providers, which generates

more competition and lower costs. The central

west, northern (Amazon area) and northeast regions

lack providers and infrastructure, so costs are

much higher. Many companies work with independent

drivers who own their own trucks as a cost efficient

solution for transporting low-cost products such

as seeds and construction materials, but it’s

a challenge for these independent truck drivers

to secure a steady volume. Brazil’s investment

in ports and airports has been limited over the

past many years; a consequence is that containers

can sit in certain ports for weeks awaiting unloading.

Brazil’s government has resisted private

investment in infrastructure.

- Trade Zone Tradeoffs: Free trade

zones such as Manaus encourage growth in underdeveloped

areas by attracting large manufacturers, but also

serve as an example of how tax benefits alone

do not translate into logistics efficiency. Manaus

has one road in and out, which cannot take heavy

truck traffic, forcing many shippers to use air/water

freight.

- Political and Regulatory Obstacles:

Like many emerging markets, Brazil has its share

of political influences that impact supply chain

efficiency. For example, Brazil’s customs

and duty regulations have created a protectionist

market for some goods.

- Evolving Logistics Marketplace: Rapid growth has fueled demand for outsourcing, creating a fragmented marketplace populated by a range of providers. Many were started by individual truck drivers who acquired more trucks and then eventually bought a warehouse, though Brazil is also served by major national and international players. ‘‘Many logistics providers are individual-function oriented, with few integrated supply chain, value-added offerings,” says Mauricio Ferreira, Latin America Supply Chain Director for Kraft Foods. A fragmented logistics infrastructure often drives companies to maintain higher inventory levels.

‘‘In Brazil we are ten hours away from the US by air and 11 hours from the main European cities by air. It takes 17 days navigation by water to Europe and 38 to 45 days to reach China ports with direct service,” says Gilberto Zanon, Head of Industry Verticals, Brazil at Panalpina. ‘‘The longer lead times mean planning to avoid stock-outs or excess stock is a challenge that companies need to overcome. Successful companies and 3PLs work together to do this.”

Like other emerging markets, Brazil’s compelling rate of growth and potential for improvement has convinced many companies that the obstacles are worth the investment. As one participant at the eyefortransport workshop noted, emerging markets have the opportunity to build on what the developed markets have already done and then leapfrog over them. One example is the pervasive use of cell phones for banking purposes in some emerging markets.

Selecting a 3PL Partner for Emerging Markets

Entering any new market requires due diligence; when it’s an emerging market, gaining local insight is even more critical, since conditions are often evolving rapidly. 3PLs can play a critical role in both the planning and execution of shippers’ entry and growth in emerging markets.

Early in the process, shippers must ask themselves: What type of 3PL partner do we want? Is it best to seek out a local player with intimate knowledge of local practices, or a global partner with more resources to bear?

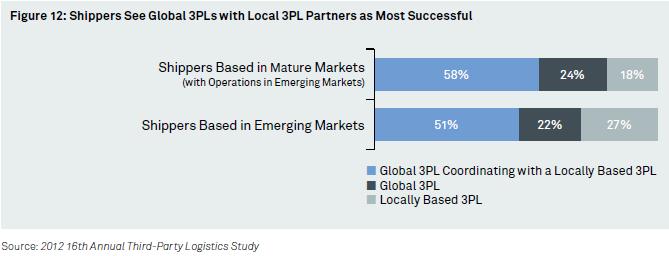

As seen in Figure 12, more than half of shippers based in both mature and emerging markets agree that a global 3PL coordinating with a local 3PL is the most successful operating model for 3PLs operating with or within an emerging market. ‘‘We look for two different types of providers,” says Tony Xia, Senior Logistics Manager with Emerson Electric. One must be ‘‘big enough to have good coverage and good IT, good assets, and can help growth and expand.” The other type is ‘‘niche players, where they are pretty good in a small piece of logistics.”

The ideal, many shippers say, is to find a global player with strong local knowledge. When they don’t find these qualities available in emerging markets, the combination of global and local 3PLs is the next best thing. Michael Keong, Director, Regional Logistics Asia, Levi Strauss and Company, noted, ‘‘We need to ensure 3PLs have the right resources, content experts, etcetera, to understand the local flavor. A strong account manager who understands the local area is important to us. That person need not know it all, but must have the right network to solve any problems that break.”

Shippers participating

in the ASE workshops illustrated the value of

local knowledge: One shared the story of a global

company that established a supply warehouse in

China to US specifications, only to find the unloading

docks to be at the wrong height for local supply

trucks.

Another shipper found its pallet shifters did

not work in the narrow-bodied aircraft coming

out of Panama.

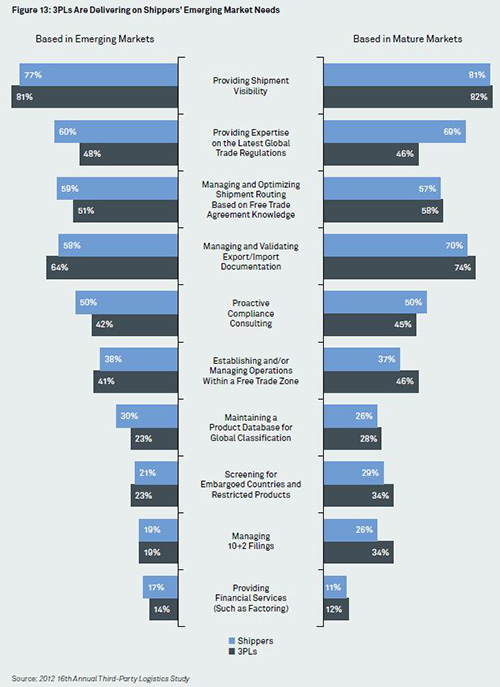

Signs indicate that the combination of global and local players is working; as seen in Figure 13, shippers and 3PLs are pretty well aligned in what they believe are the most important services in emerging markets. Shippers’ primary needs from 3PLs in emerging markets are visibility (77% of those based in emerging markets, 81% of those based in mature markets), expertise on the latest global trade regulations (60% and 69%) and managing and optimizing shipment routing based on free trade agreement knowledge (59% and 57%).

Visibility: With the added risk and uncertainty of emerging markets, the importance of visibility to shippers is understandable. ‘‘Delivering products in Russia is complex,” says Panalpina’s Gaechter, ‘‘and visibility over where our customers’ products are and a reliable service to ensure products arrive on time are two critical aspects of our customers’ needs. This is no different than, for example, China, where lead-time from factory to exporting port can take many days. Visibility and reliability play a key role there as well, and excelling in this is more difficult in emerging markets than more mature markets.”

It’s highly important for service-centric computer manufacturers to be able to provide order-level tracking to customers, says the Supply Chain Director for a large computer company, and 3PLs need this capability to provide visibility to customers. Even better is a 3PL taking proactive steps to resolve issues detected through visibility, which many 3PLs in emerging markets do not do, he says.

Global Trade Regulations: As noted in Figure 13, 3PLs active in emerging markets concur with shippers’ rankings, with the exception of providing expertise on the latest global trade regulations. Shippers ranked this as the second most important service they would like to get, whereas 3PLs in mature and emerging markets ranked it somewhere in the middle.

Compliance: In emerging markets, many shippers rely on 3PL expertise to navigate import/export documentation, embargoed products/countries screening and other compliance services. ‘‘It would be useful for 3PLs to have better relationships with customs officers to ensure they have local input, etcetera,” said Levi Strauss’ Keong. ‘‘3PLs should engage more in customs meetings and be the conduit to discuss customer requirements.”

Other Services Sought From 3PLs

In addition to those capabilities cited in the survey, ASE workshop and focus interview participants concur that they would like to see these additional qualities and capabilities in 3PLs active in emerging markets:

- Proactive

Consulting Services: At the ASE workshop

held in Utrecht, shippers concurred that the timing

of 3PLs’ assistance was also key. Very often

an initiative to move into an emerging market

begins with the shipper conducting initial research

because their 3PL partners lack insight into that

market. Then the 3PL follows, ramping up its own

investigation. Shippers would like to see 3PLs

take a more proactive approach — and are

willing to pay for it.

- Local Insight

and Expertise: It’s the lack of

local expertise on the part of global 3PLs without

a strong local presence, such as the best way

to move product in that country, that drives shippers

to local 3PLs and other experts. Shippers want

creative, informed ideas to overcome local barriers,

for example, using a barge in Vietnam to circumvent

road congestion, or overland or cross-border trucking

in India and Bangladesh – or even how to

handle local events such as labor stoppages.

In one telecom company’s emerging markets experience, ‘‘Logistics service providers fail to come up with new logistics solutions or improvements,” says its Head of Distribution. ‘‘Any new solution or idea is brought up ourselves. This is where LSPs really fail.”

- Integrated

Solutions: Shippers that want to amass

the requisite logistics services and knowledge

required for an integrated approach often find

they must engage multiple 3PLs because no single

3PL has what they need. One ASE participant related

how his company was seeking integrated warehouse

and transportation services in an emerging market

it was entering, ideally with the warehouses located

close to air hubs. But the 3PL they wanted to

work with was not set up to accommodate the shipper’s

needs.

- Security:

Shippers in emerging markets expect 3PLs to address

their security concerns through measures such

as delivery trucks with GPS systems, engine shut-down

systems, and drivers trained on security protocols.

- Long-Term

Commitment: It’s also important

that 3PLs’ efforts be strategic, not tactical.

‘‘3PLs still lack a longer term sustainable

plan for coming into a country,” says Arun

Salvi, Logistics Manager Asia Pacific, for Shell

Lubricants. ‘‘They are taking more of a short-term

approach to make profits much quicker than they

should be.

Global players end up being like the local players, but with a foreign name, because they have not invested properly in infrastructure, people and processes.”

All of these points can make for a difficult environment and require 3PLs and shippers to work closely together and with high degrees of trust if success in emerging markets is to be achieved. This might be one of the reasons people choose global 3PLs working with local players.

Free-Trade Agreements and 3PLs

A free trade agreement (FTA) is a pact between two or more countries or areas in which they agree to lift most or all tariffs, quotas, special fees and taxes, and other barriers to trade among them to allow faster transactions and a higher volume of business. According to the United Nations Statistics Division, FTAs such as the North American Free Trade Agreement (NAFTA), the European Union (EU-27) and the Organisation for Economic Co-operation and Development (OECD) have made a definitive impact on growth across sectors such as machinery, manufactured goods and chemicals.

FTAs, free trade

zones (FTZ) and Special Economic Zones (SEZ) have

in turn fuelled the growth of third-party logistics

companies around these zones. For example, increasing

partnerships between US and Mexican carriers via

NAFTA have led to growth of logistics companies

on both sides of the border, including 3PLs, customs

brokers and forwarders. Mexico’s maquiladora

factory system allows materials to be imported

into Mexican towns near the US border, tariff

and duty free; after assembly, the finished products

are exported duty-free back to the US.

The automotive, garment and electronics industries

make significant use of the maquiladora system.

Many partner with 3PLs for activities such as

transportation and reverse logistics.

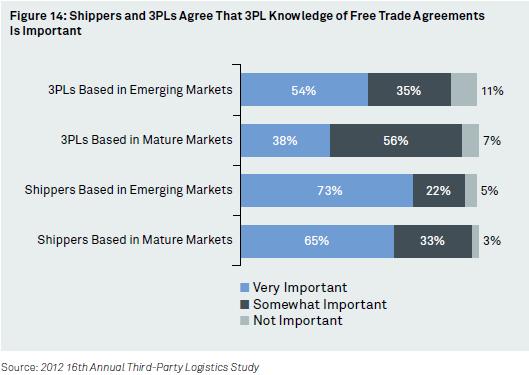

With such high stakes, it’s not surprising that the majority of shippers in mature and emerging markets call 3PLs’ knowledge of FTAs very important (65% and 73%, respectively), as seen in Figure 14. 3PLs feel somewhat less strongly; just 54% of those in emerging markets and 38% of those in mature markets agree.

Understanding and keeping up with the changes and nuances of each FTA can be critical to reaping the benefits. ‘‘Free trade is not free trade, it’s more conditional trade agreements,” says one apparel manufacturer. One example of the need for deep understanding is in China’s FTA, he explains. ‘‘There is a ‘40% regional content’ rule, but many people do not understand what this means. When we ask the experts, we find production and labor costs count towards the 40%, which can significantly impact the attractiveness of doing business there.”

The VP of Operations at a large software and peripherals developer says FTAs have ‘‘allowed us to expand our business market, although they have not alleviated significant duties and taxes.” Others cite the significant paperwork that still must be filed to qualify for the FTA benefits, requiring administrative resources. Shippers value 3PLs that can streamline these processes and maximize FTA/FTZ resources through knowledge and execution of compliant processes.

Using 3PLs in free

trade zones has been beneficial for a large pharmaceutical

company, according to its VP Logistics. For example,

the company delivers product from US and Australian

factories into an FTZ warehouse in Panama for

distribution to surrounding countries, avoiding

duties and holding inventory closer to its markets.

‘‘The 3PL does bring the knowledge, and it

also brings consolidation of customs entries,”

he says. ‘‘With FTZ we can consolidate multiple

$300-per-entry monthly customs entries into one

$300 entry. That saves us $8,700 per month, a

pretty big savings that adds up to $100K annually.”

Free trade agreements can be an important factor in choosing whether to enter an emerging market, and the most advantageous ways to operate in that market.

|

Index:

About Capgemini Consulting

With more than 115,000 people in 40

countries, Capgemini is one of the world’s

foremost providers of consulting, technology

and outsourcing services. The Group reported

2010 global revenues of EUR 8.7 billion.

Together with its clients, Capgemini creates

and delivers business and technology solutions

that fit their needs and drive the results

they want. A deeply multicultural organization,

Capgemini has developed its own way of

working, the Collaborative Business ExperienceTM,

and draws on Rightshore®, its worldwide

delivery model.

Capgemini Consulting is the Global Strategy

and Transformation Consulting brand of

the Capgemini Group, specializing in advising

and supporting organizations in transforming

their business, from the development of

innovative strategy through to execution,

with a consistent focus on sustainable

results. Capgemini Consulting proposes

to leading companies and governments a

fresh approach which uses innovative methods,

technology and the talents of over 3,600

consultants worldwide.

For more information: http://www.capgemini-consulting.com/